[Eng] Aging Summary

Report Name |

Aging Summary |

Open Link |

Log in – Front Office – Reports – Aging Summary |

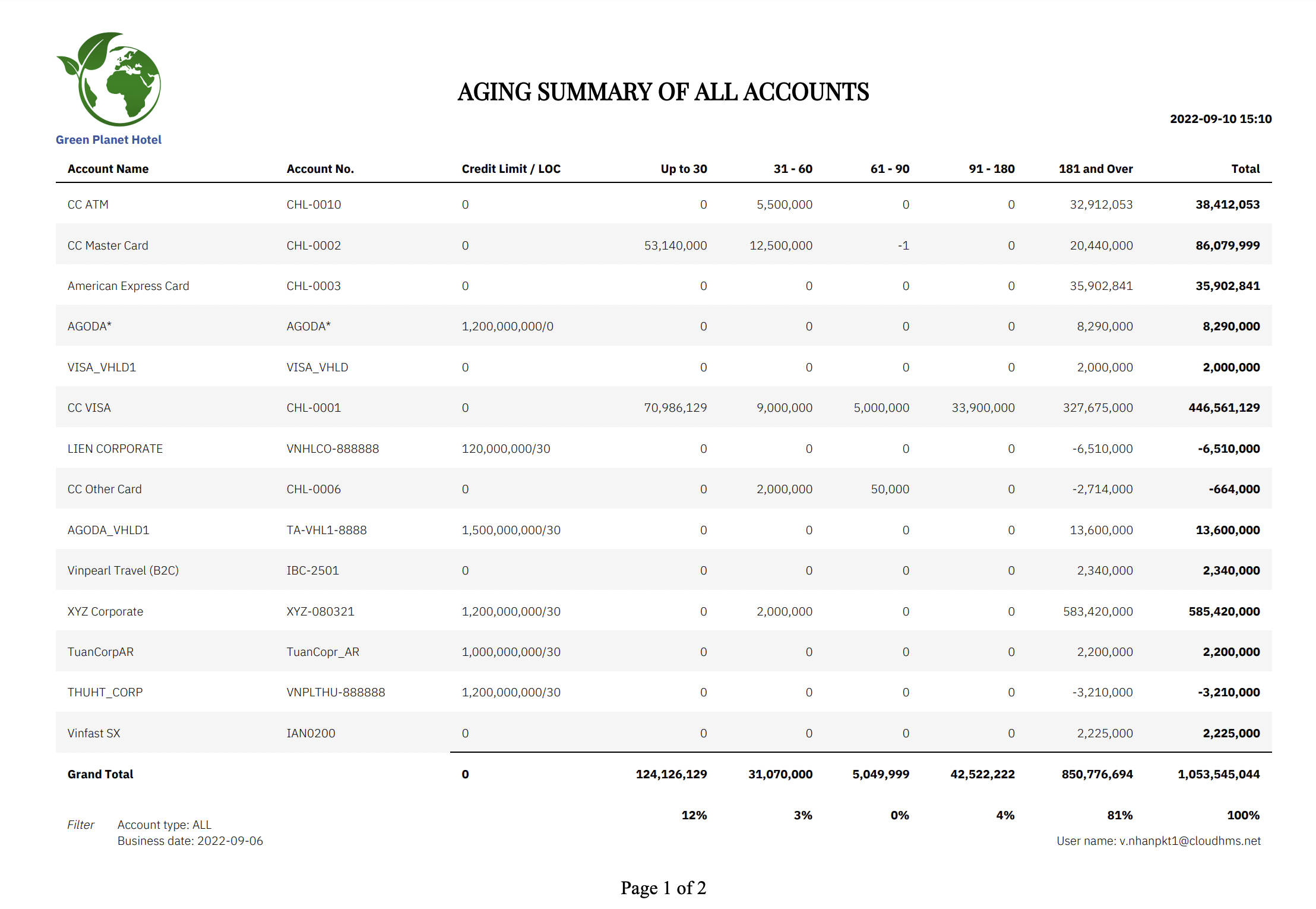

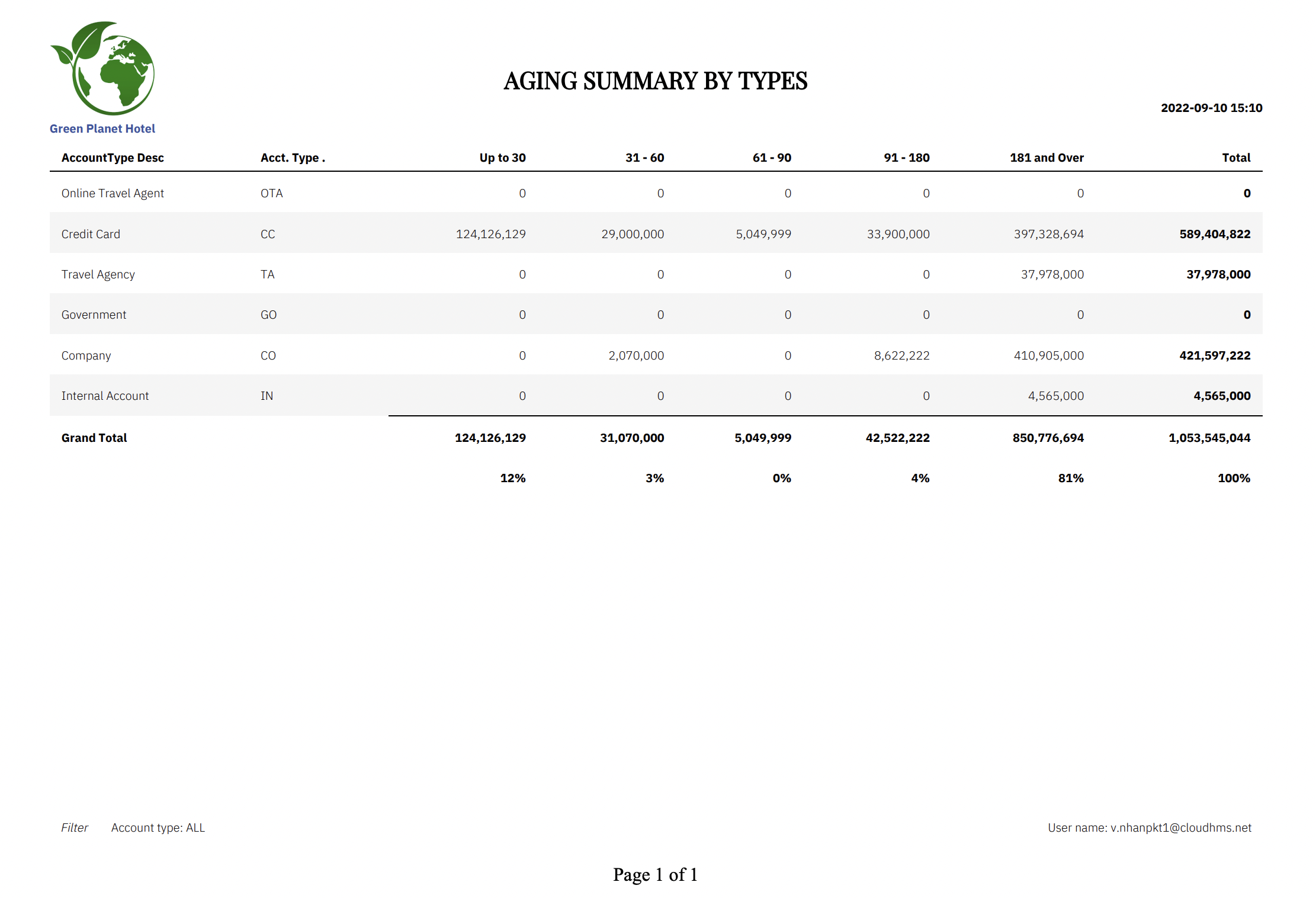

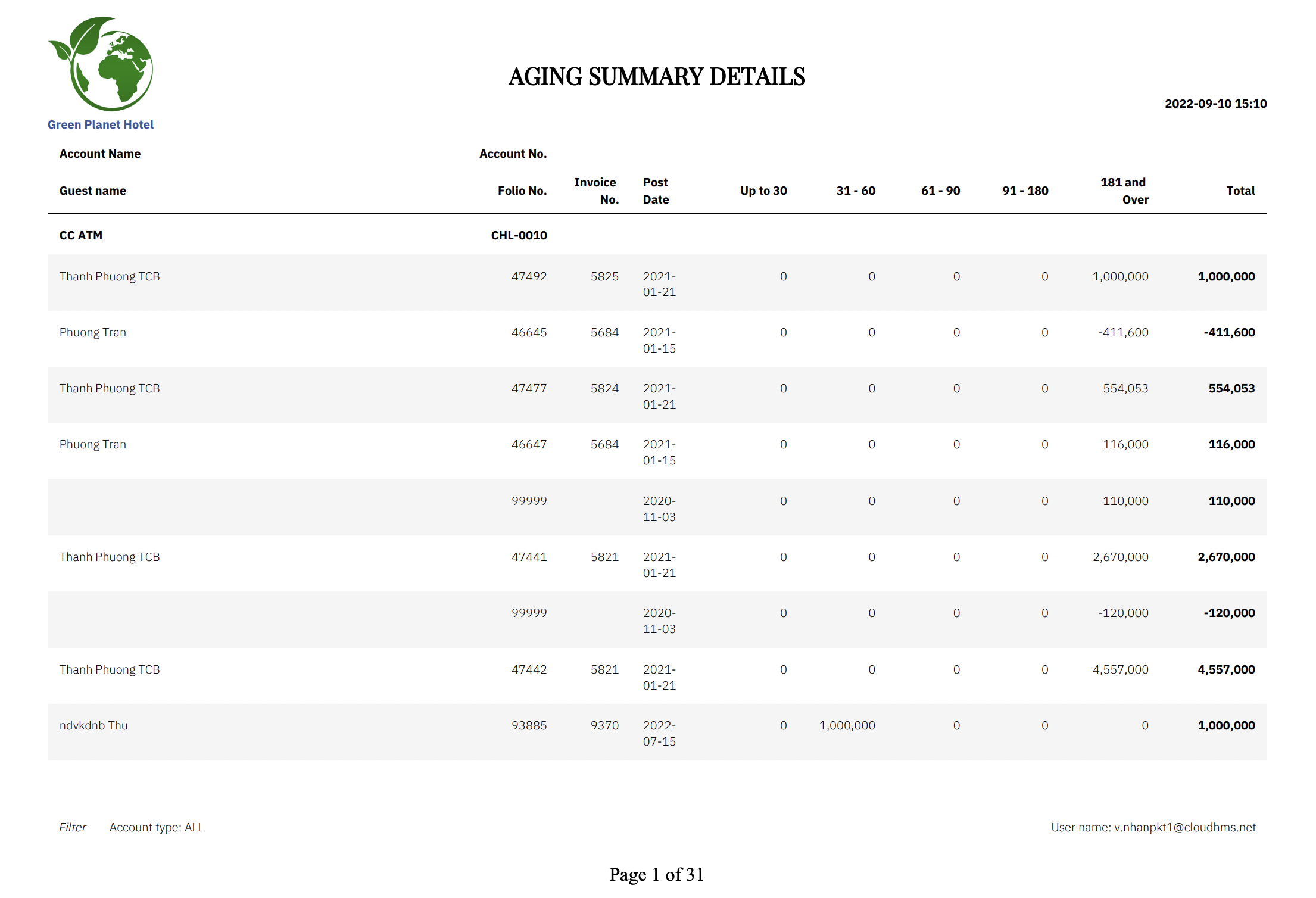

Report Summary |

The report displays the current outstanding balance of each Account Type by Aging Level. The report is based on the actual AR date and the selected business date to calculate the AR aging. |

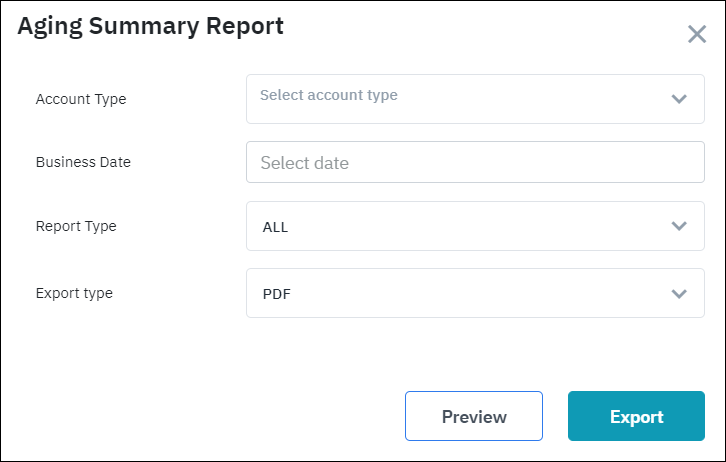

Report Filter |

|

Report Form |

Template Aging Summary of All Accounts Template Aging Summary by Types Template Aging Summary Details |

Column Description |

Report Type = ALL

Report Type = TYPE

Report Type = DETAIL

Aging level

The report is based on the actual AR date and the selected business date to calculate the AR aging. For example: The AR transaction is posted on 01/01

|

Remarks |

N/A |